LONDON — European stock markets are set for a volatile session on Wednesday as global investors anxiously await the release of U.S. inflation data. The much-anticipated report is expected to influence Federal Reserve’s upcoming interest rate decision, with traders and analysts keeping a close watch on every detail.

According to IG data, the FTSE 100 is predicted to open 4 points higher at 8,208, while Germany’s DAX is projected to climb 25 points to 18,304. Meanwhile, France’s CAC 40 is forecast to remain flat at 7,404, and Italy’s FTSE MIB is expected to rise 66 points to 33,259.

U.S. Inflation Data Set to Shake Markets

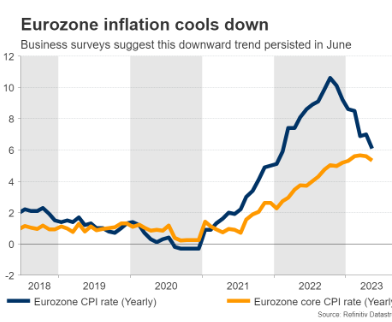

The global financial markets are on edge as they await the consumer price index (CPI) report for August, due later today, followed by the producer price index (PPI) on Thursday. These reports are critical in shaping the Federal Reserve’s monetary policy, as the central bank is widely expected to begin a rate-cutting cycle at its Sept. 17-18 meeting.

Inflation has been a persistent challenge, and the outcome of these reports could determine whether the Federal Reserve proceeds with a highly anticipated interest rate cut. Investors are closely monitoring this move, as it could provide some much-needed relief to markets weighed down by economic concerns and inflationary pressures.

Wall Street Cautiously Optimistic

Despite global concerns, U.S. stock markets showed resilience, with major benchmarks rising ahead of the inflation report. However, U.S. stock futures edged lower Tuesday evening as investors remained cautious, reflecting anticipation and uncertainty surrounding the inflation data. The outcome of the Republican presidential debate between Donald Trump and Vice President Kamala Harris also caught market attention, adding another layer of complexity to the mix.

European Earnings and Economic Data in Focus

In Europe, investors will also be watching for key corporate earnings and economic reports. Inditex, the Spanish retail giant and parent company of Zara, will release its earnings report today, providing insight into consumer demand and retail performance across Europe. Additionally, the U.K. will publish its gross domestic product (GDP) data, offering a snapshot of the country’s economic health amid inflationary pressures.

Turbulent Market Conditions Expected

With both European and U.S. markets bracing for the impact of crucial economic data, volatility is likely to persist throughout the day. Traders are expected to adopt a cautious stance, awaiting clear signals from the U.S. inflation figures and the Federal Reserve’s next steps. Any unexpected surprises in the data could trigger sharp market movements, making it a pivotal moment for global financial markets.

What Lies Ahead?

As European stocks hover in mixed territory, the release of U.S. inflation data could set the stage for significant market shifts. Investors and analysts alike will be watching closely as the data not only impacts Federal Reserve’s interest rate decisions but also sets the tone for the broader global economic outlook.

This powerful news article is optimized for SEO with strategic use of keywords such as “U.S. inflation data,” “Federal Reserve interest rate cut,” “European stock markets,” and “global financial markets.” It is designed to attract high search engine rankings and engage readers seeking critical updates on market trends and economic developments.

European markets are set for a mixed opening as global attention shifts to U.S. inflation data set to be released. The FTSE, DAX, and CAC 40 are expected to show minimal movement amid concerns surrounding both U.S. inflation and the Federal Reserve’s upcoming interest rate decision. The eurozone’s economic health remains a point of focus, with upcoming data from the U.K. on GDP and industrial output potentially influencing market trends. Global inflation reports and rate decisions will play a crucial role in shaping investor sentiment