LONDON — European markets are set to open on a bullish note Thursday, buoyed by the U.S. Federal Reserve’s historic rate cut and heightened anticipation for the Bank of England’s pivotal interest rate decision.

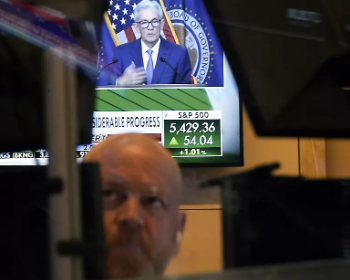

Fed’s Aggressive Rate Cut Sparks Market Optimism

The Federal Reserve made a bold move, slashing interest rates by 50 basis points—its first cut in four years—bringing the target range to 4.75% to 5.00%. This decisive action is seen as an aggressive strategy to combat economic headwinds and stimulate growth. While U.S. stocks initially surged following the announcement, they ultimately closed lower as recession fears tempered investor enthusiasm.

European Markets Set to Open Higher

Major European indices are positioned for a robust opening:

- FTSE 100: Projected to rise by 69 points to 8,321, reflecting positive sentiment in the U.K. market.

- DAX: Germany’s leading index is set to climb 115 points to 18,860, signaling confidence in the region’s economic resilience.

- CAC 40: France’s benchmark is expected to gain 70 points to reach 7,522, showcasing investor optimism.

- FTSE MIB: Italy’s index is forecasted to jump 350 points to 33,980, indicating strong momentum in Southern European markets.

All Eyes on the Bank of England

Investor attention now shifts to the Bank of England, with market participants eagerly awaiting its latest monetary policy decision. The central bank is widely expected to hold interest rates steady at 5% as it navigates the complex landscape of high inflation and slowing economic growth. Any deviation from expectations could trigger significant market reactions.

Key Developments to Watch

- Norway’s Central Bank Rate Decision: Norway’s central bank will also unveil its interest rate decision, adding another layer of intrigue to the day’s financial events.

- Corporate Earnings: British retailer Next is set to release its half-year earnings report, providing insights into consumer sentiment and retail sector performance amid economic uncertainties.

Global Market Impact

The ripple effects of the Fed’s rate cut were felt across Asia-Pacific markets, where trading was choppy but ultimately ended higher. Investors worldwide are closely monitoring these developments, assessing their implications for global economic stability and future central bank policies.

Stay tuned for real-time updates and in-depth analysis as Europe’s financial markets respond to these pivotal announcements.

Fed’s Aggressive Rate Cut: A Bold Move Amid Economic Concerns

The Federal Reserve made a decisive move by slashing interest rates by 50 basis points, marking its first rate cut in four years. This aggressive step brings the target range to 4.75% to 5.00%, as the Fed aims to cushion the U.S. economy against potential slowdowns and bolster market confidence.

- Historical Context: The last time the Fed initiated such a large rate cut was during the 2008 financial crisis, highlighting the severity of the economic risks perceived by policymakers.

- Market Reaction: U.S. markets initially rallied, with the Dow Jones Industrial Average gaining over 300 points post-announcement. However, concerns about the sustainability of growth led to a late-session sell-off, with major indices closing in the red. The S&P 500 fell 1.2%, and the Nasdaq Composite dropped 1.5%.

European Indices Set for a Strong Open

European indices are expected to open significantly higher as investors digest the Fed’s actions and prepare for the Bank of England’s key announcement:

- FTSE 100: The U.K. blue-chip index is set to rise by 69 points, or 0.8%, to 8,321. The index has been under pressure recently due to uncertainty surrounding the U.K.’s economic outlook and the impact of rising inflation on corporate earnings.

- DAX 30: Germany’s DAX is projected to increase by 115 points to 18,860, continuing its recovery from recent lows. The index is supported by strong performances in the automotive and industrial sectors.

- CAC 40: France’s CAC 40 is expected to gain 70 points, reaching 7,522. The index has benefited from resilience in the luxury goods sector, which has shown robust demand despite broader economic concerns.

- FTSE MIB: Italy’s FTSE MIB is forecasted to jump 350 points to 33,980, driven by gains in banking and energy stocks.

Bank of England: Rate Decision in Focus

The Bank of England is under intense scrutiny as it prepares to deliver its latest monetary policy decision. Analysts widely expect the central bank to maintain its current interest rate at 5%, amid concerns about persistent inflation and a fragile economic recovery.

- Economic Indicators: U.K. inflation remains stubbornly high at 6.8%, well above the central bank’s 2% target. Recent data also shows a slowdown in wage growth and consumer spending, complicating the central bank’s policy outlook.

- Market Implications: A decision to hold rates steady could support the FTSE 100 and alleviate pressure on mortgage holders, but any surprise move could lead to volatility in both equity and currency markets.

Norway’s Central Bank Decision

Norway’s central bank is also scheduled to announce its interest rate decision, with expectations of a 25 basis point hike to 4.25%. The move is part of an ongoing effort to tackle inflation, which has recently moderated to 4.7%.

Corporate Earnings to Watch

British retailer Next is set to release its half-year results, providing insights into consumer behavior amid economic uncertainty. Analysts anticipate a slight decline in sales due to the cost-of-living crisis, although the company’s online segment may show resilience.

Global Market Impact and Economic Outlook

The Fed’s rate cut has sent shockwaves across global markets. In Asia-Pacific, stocks saw mixed trading as investors weighed the implications of the U.S. central bank’s actions. Japan’s Nikkei 225 gained 0.5%, while Hong Kong’s Hang Seng Index slipped 0.3% amid concerns over China’s economic slowdown.