Federal Reserve Chair Jerome Powell has introduced a new buzzword: “recalibration.” This term is part of the Fed’s latest strategy to fine-tune its monetary policy at a crucial moment for the U.S. economy.

What Is Recalibration?

Powell used “recalibration” to describe a shift in the Fed’s policy direction, aimed at supporting the labor market without suggesting an economic downturn. This new approach included a surprising half-percentage-point rate cut, a move rarely seen without a looming recession.

Why Did the Fed Make This Move?

The rate cut was not in response to a weakening economy but rather an effort to maintain economic growth and job stability. Powell emphasized that the policy shift is meant to protect the labor market and keep the economy strong as inflation trends closer to the Fed’s target.

“It allows Powell to push the narrative that this easing cycle is not about recession fears but extending the economic expansion,” said Tom Porcelli, chief U.S. economist at PGIM Fixed Income.

Market Reaction

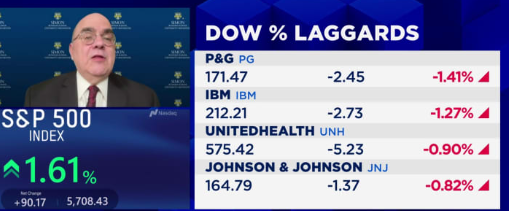

Investors reacted positively. The Dow Jones and S&P 500 jumped to new highs after Powell’s announcement, as markets interpreted the move as a proactive step to support the economy rather than a response to a crisis.

What’s Next for the Fed?

Analysts expect more quarter-point rate cuts through early 2025, but futures markets hint at a possible return to larger cuts if the labor market weakens. “We think the Fed will end up front-loading rate cuts more than it has indicated,” said Aditya Bhave, an economist at Bank of America.

The Bigger Picture

Powell’s “recalibration” strategy reflects the Fed’s flexible approach to balancing economic growth and job stability. It’s a clear message: the central bank is willing to adapt its policies to protect the U.S. economy.

With this new direction, Powell aims to keep the economy on track without overreacting to short-term data or market pressures, ensuring that the Fed remains a steady hand on the economic tiller.

Federal Reserve Chair Jerome Powell’s recent emphasis on the term “recalibration” reflects a strategic shift in the central bank’s monetary policy. This change was marked by a half-percentage point interest rate cut on September 18, 2024, a move that diverged from the typical quarter-point adjustments. Powell’s decision aims to balance the ongoing economic expansion with emerging risks in the labor market, signaling a pivot from a strict focus on inflation to supporting employment stability.

The recalibration approach is partly due to inflation easing closer to the Fed’s target of 2%, alongside a rising unemployment rate now at 4.2%. This suggests the Fed is now more concerned with preventing a downturn in the labor market rather than combating inflation alone. The move is seen as a proactive step to prevent potential economic slowdown, with plans to reduce rates further over the next year to support growth without triggering a recession.

The reaction from financial markets has been mixed. Initially, the stock markets surged, interpreting the move as a sign of confidence in the economy. However, there are concerns that such a substantial rate cut might be seen as overreaction given the relatively strong economic indicators, including a 3% growth forecast for the current quarter.

This recalibration also has implications for the gold market. Following the announcement, gold prices initially surged to record highs but later fluctuated, reflecting uncertainty about the long-term impacts of the Fed’s policy shift on the broader economy and inflation expectations.

These actions underscore the complex dynamics the Fed faces as it navigates the dual mandate of promoting maximum employment and stabilizing prices, especially in the lead-up to the 2024 U.S. presidential election.

Jerome Powell’s recent announcement of a “recalibration” of the Federal Reserve’s policy signals a strategic shift in its approach, reflecting a response to various economic conditions. This move includes a surprising half-point rate cut aimed at bolstering the labor market, which has shown signs of weakening. The unemployment rate has risen to 4.1%, the highest since late 2021, while job gains have slowed significantly in recent months. The Fed’s primary goal is to prevent further deterioration in the labor market while balancing inflation control, which has moderated more quickly than expected.

The rate cut is expected to influence various economic sectors. For consumers, it could lower borrowing costs, although immediate effects may take time to materialize. Businesses, especially small and medium enterprises, might benefit from reduced loan costs, potentially spurring investment and growth. However, the Fed remains cautious about rekindling inflation and is closely monitoring incoming data before deciding on further cuts