In a surprising turn of events, Japanese Prime Minister Shigeru Ishiba made dovish comments regarding the nation’s interest rates, which have sparked a notable reaction in currency markets. Despite these remarks, experts and market analysts are holding firm to their expectations for future rate hikes by the Bank of Japan (BOJ).

Dovish Remarks from the Prime Minister

During a press conference following his meeting with BOJ Governor Kazuo Ueda, Prime Minister Ishiba stated, “I do not believe that we are in an environment that would require us to raise interest rates further.” This statement marked a significant shift from Ishiba’s previous stance and was perceived as a signal that the government may not prioritize aggressive monetary tightening in the near future.

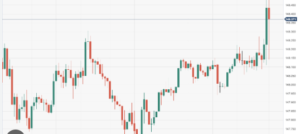

As a result, the Japanese yen experienced a sharp decline, trading as weak as 147.15 against the U.S. dollar, marking its largest single-day drop since June 2022. Analysts are closely watching how the yen will respond to the evolving monetary landscape.

Market Reactions and Expectations

Despite Ishiba’s dovish comments, analysts remain steadfast in their expectations for the BOJ’s future rate policy. Stefan Angrick, senior economist at Moody’s Analytics, expressed confidence that a rate hike could occur as soon as October, citing the latest BOJ meeting minutes that maintained an optimistic outlook on the economy. The futures market reflects these sentiments, indicating less than a 50% chance of a rate hike of 10 basis points by the end of 2024, according to LSEG data.

Asahi Noguchi, a BOJ board member, also reiterated the need for the central bank to maintain its accommodative monetary policy. He emphasized that altering public perceptions about inflation will take time, indicating that a cautious approach remains prudent.

The BOJ’s Recent Actions

In September, the BOJ decided to keep its benchmark interest rate steady at around 0.25%, the highest level since 2008. This followed a rate increase in July, which marked the first rate hike in 17 years. While the BOJ board was divided on future interest rate paths during the September meeting, they acknowledged that economic activity and inflation were developing in line with the bank’s projections.

The next crucial BOJ meeting is scheduled for October 30-31, where updated forecasts for growth and prices will be released. Some analysts anticipate that the upcoming general elections on October 27, which will determine control of Japan’s lower house, may influence the BOJ’s decisions.

Factors Influencing Future Rate Hikes

Market experts, including Ken Matsumoto of Crédit Agricole CIB, expect that any immediate plans for a rate hike may have been complicated by Ishiba’s recent announcements regarding the general election. However, they still anticipate that a hike could be on the table in January 2025, depending on several economic indicators.

Mazen Issa, a fixed income strategist at MRB Partners, commented that while another rate hike could occur by the end of 2024, the decision will largely depend on external factors such as currency stability and the performance of the U.S. economy.

The interplay between interest rates and the value of the yen remains critical. Historically, higher interest rates bolster the yen, but this can negatively affect Japan’s exporters by making their products less competitive abroad. Thus, the BOJ’s decisions must carefully balance domestic economic health with international competitiveness.

The Carry Trade and Its Impact

The dynamics of the yen carry trade further complicate the situation. A carry trade involves borrowing in a low-interest currency, like the yen, to invest in higher-yielding currencies. When the BOJ previously raised rates, it triggered a significant unwinding of these trades, leading to volatility in global markets.

Issa noted that the BOJ and the government have coordinated efforts to stabilize the yen following these shifts. He highlighted that while the fundamental outlook suggests the BOJ is poised to hike rates by 2025, timing remains contingent upon key economic developments.

As Japan navigates this delicate economic landscape, the interplay between political signals and monetary policy will be critical. While Prime Minister Ishiba’s dovish comments may momentarily sway market perceptions, analysts are maintaining their longer-term expectations for the BOJ.

Future rate decisions will depend heavily on inflation trends, currency stability, and the overall health of both the domestic and global economies. Investors and stakeholders will be closely monitoring the BOJ’s upcoming meetings and government actions to assess the trajectory of Japan’s monetary policy and its implications for the yen and broader economic stability.

Current Context

As Japan grapples with a challenging economic environment, the recent comments from Prime Minister Shigeru Ishiba have sparked significant discussions among economists and market analysts. Ishiba’s dovish stance, suggesting no immediate need for further interest rate hikes, reflects a notable pivot in the government’s approach to economic policy.

The Yen’s Fluctuation

The yen’s steep decline to 147.15 against the U.S. dollar following Ishiba’s remarks underscores the currency’s sensitivity to political statements and monetary policy expectations. A weaker yen can benefit exporters by making Japanese goods cheaper abroad but also poses risks of inflation as import costs rise.

BOJ’s Recent Rate Changes

In July 2024, the BOJ raised its benchmark interest rate from a range of 0% to 0.1% to around 0.25%. This marked the first increase in 17 years and was seen as a pivotal moment in the BOJ’s long-standing ultra-loose monetary policy. The decision reflected concerns about rising inflation, which had been influenced by global supply chain disruptions and increased energy costs.

Economic Indicators and Predictions

Inflation Trends

Inflation in Japan has been slowly increasing, reaching levels not seen in decades. The BOJ aims to achieve a sustainable inflation rate of 2%. Recent inflation data indicates that while consumer prices are rising, the underlying growth in wages has not kept pace, posing challenges for the central bank’s targets.

Economic Growth

Japan’s economic growth has shown signs of recovery, but uncertainties remain. Factors such as global economic conditions, trade dynamics, and domestic consumption levels are critical in shaping the outlook. Analysts are particularly focused on the upcoming October 30-31 BOJ meeting, where updated forecasts for growth and inflation will be provided.

The Role of Political Dynamics

Upcoming Elections

The upcoming October 27 general elections in Japan add another layer of complexity. Political stability and the party in power can significantly influence economic policy. Ishiba’s recent comments could be interpreted as an attempt to reassure the public and markets ahead of this pivotal moment.

Government Coordination with the BOJ

The coordination between the Japanese government and the BOJ has intensified in recent months, signaling a more integrated approach to economic policy. This alignment is crucial as both entities seek to navigate the challenges posed by a fluctuating currency and shifting global economic conditions.

Market Expectations

Analysts’ Predictions

Despite Ishiba’s dovish tone, many analysts, including Ken Matsumoto and Mazen Issa, maintain that the BOJ is on track to consider further rate hikes. Expectations for a rate increase in January 2025 are growing, depending on economic indicators such as inflation, the stability of the yen, and global economic performance.

Interest Rate Futures

The futures market indicates a less than 50% probability of a rate hike by the end of 2024. This reflects uncertainty regarding the BOJ’s immediate course of action, influenced by Ishiba’s remarks and broader economic trends.

Global Implications

Carry Trade Dynamics

The concept of the carry trade remains pivotal in understanding the yen’s performance. As interest rates in Japan rise, the carry trade’s attractiveness may diminish, leading to volatility in financial markets. Investors have been unwinding these trades, which had previously driven significant capital flows into higher-yield currencies.

Comparative Analysis with Other Economies

Japan’s monetary policy trajectory is closely watched in the context of global economic trends. As central banks in the U.S. and Europe also adjust their monetary policies, Japan’s decisions could have ripple effects on global markets, particularly in the context of currency strength and trade dynamics.

Conclusion

Japan’s monetary policy landscape is characterized by a delicate balancing act. As Prime Minister Ishiba’s dovish comments echo through markets, analysts remain vigilant in their expectations for the BOJ. The interplay of domestic politics, global economic conditions, and inflationary pressures will shape the future trajectory of Japan’s interest rates.

The upcoming BOJ meetings and economic forecasts will be critical in determining whether Japan can maintain a sustainable growth path while managing the complexities of a changing economic environment. Stakeholders, investors, and policymakers will be closely monitoring these developments as they unfold.