SEO Keywords: European markets higher open August 2024, Stoxx 600 index performance, U.S. Federal Reserve interest rate outlook, Jerome Powell Jackson Hole symposium, global economic indicators, Fed rate cut expectations

Key Points:

- European stock markets are set to open higher on Wednesday as investors await key insights from the U.S. Federal Reserve regarding inflation and interest rate policies.

- The Stoxx 600 index, which tracks broad European market performance, closed in negative territory on Tuesday, breaking a streak of gains since the global sell-off from August 1-5.

- France’s CAC 40, the U.K.’s FTSE 100, and Germany’s DAX are all expected to open slightly higher, reflecting cautious optimism in the European markets.

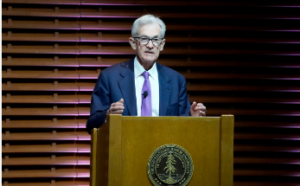

- Attention is focused on the Federal Reserve’s upcoming statements, with investors keenly awaiting the release of minutes from the Fed’s recent meeting and Fed Chair Jerome Powell’s speech at the Jackson Hole symposium on Friday.

- The market is anticipating an interest rate cut in September, with a higher probability of a 25 basis point reduction compared to a 50 basis point cut.

- Economic indicators from the U.S. have shown mixed signals, including stronger-than-expected retail sales and initial jobless claims, adding to the complexity of the Fed’s policy decisions.

- Analysts suggest that despite various risks, the overall conditions for equity markets remain positive due to easing inflation and steady economic growth.

European Stocks Set to Rebound

European equities are poised for a higher open on Wednesday, following a day of declines. The Stoxx 600 index, which measures the performance of large, mid, and small-cap stocks across 17 European countries, experienced a downturn on Tuesday. This decline marked a pause in the upward trend observed since the early August global market turbulence.

Index Movements:

- France’s CAC 40: Expected to rise by 7 points, reaching 7,490.

- U.K.’s FTSE 100: Projected to gain 4 points.

- Germany’s DAX: Anticipated to increase by 10 points.

Focus Shifts to U.S. Federal Reserve

The primary focus for European investors is the U.S. Federal Reserve, with significant attention on the upcoming release of minutes from the Fed’s last meeting. Additionally, Fed Chair Jerome Powell is scheduled to speak at the annual Jackson Hole Economic Symposium on Friday, which is expected to provide further insights into the Fed’s monetary policy direction.

The market has largely priced in an interest rate cut by the Fed in September. According to CME’s FedWatch tool, there is a 67.5% probability of a 25 basis point cut and a 32.5% chance of a 50 basis point reduction. Powell’s speech is anticipated to offer clues on whether the Fed will adopt a more hawkish or dovish stance going forward.

Economic Data and Market Sentiment

Recent U.S. economic data have been a mixed bag. Retail sales for July exceeded expectations, and initial jobless claims were lower than forecasted. These indicators suggest a resilient economy but also add uncertainty to the Fed’s decision-making process.

Charles-Henry Monchau, Chief Investment Officer at Bank Syz, noted the current economic environment is close to a “Goldilocks” scenario, where inflation is moderating, economic growth is stable, and corporate earnings are robust. He suggested that despite ongoing risks, the conditions for equity markets remain favorable.

Asian Markets and Global Context

Asian markets were generally lower on Wednesday, following a negative session on Wall Street. This decline in Asia reflects broader global market uncertainties and investor caution.

As European markets prepare for a higher open, the focus remains on the Federal Reserve’s upcoming decisions and commentary. The interplay between U.S. economic indicators, Fed policy, and global market sentiment will be crucial in shaping market trends in the coming weeks.

- Federal Reserve Focus:

- Minutes Release: The Federal Reserve will release minutes from its last meeting today, providing insights into the central bank’s stance on monetary policy.

- Jackson Hole Symposium: Fed Chair Jerome Powell will speak at the Jackson Hole Economic Symposium on Friday. His speech is highly anticipated for clues on future monetary policy.

- Interest Rate Expectations: The market is expecting an interest rate cut in September, with a 67.5% probability for a 25 basis point cut and a 32.5% chance for a 50 basis point reduction.

- U.S. Economic Data Impact:

- Retail Sales: July retail sales surpassed expectations, signaling strong consumer spending.

- Jobless Claims: Weekly initial jobless claims came in below forecasts, indicating a robust labor market.

- Global Market Context:

- Asian Markets: Asian equities showed broad declines in response to global market trends and uncertainty about economic growth.

- Oil Prices: Recent declines in oil prices have been influenced by rising U.S. crude inventories and easing Middle East tensions, affecting overall market sentiment.

Economic Indicators:

- Eurozone Purchasing Managers’ Index (PMI): Flash PMI figures for the euro area will be released on Thursday, providing a snapshot of economic activity in the region.

- Inflation Trends: Inflation in the euro area remains a critical concern, impacting central bank policies and market expectations.

- Economic Growth: Despite recent setbacks, economic growth in the euro area shows signs of resilience, supported by strong corporate earnings and stable consumer spending.

Market Sentiment:

- Charles-Henry Monchau’s Insights: Monchau, Chief Investment Officer at Bank Syz, suggested that the current economic conditions are favorable for equity markets. He noted that inflation is moderating, growth is steady, and earnings reports have been positive. Despite ongoing risks, such as geopolitical tensions and market volatility, the overall outlook remains positive.

- Investment Strategies: Investors are closely monitoring the Fed’s policy decisions and economic indicators to gauge future market movements. Strategies are being adjusted based on anticipated rate cuts and economic forecasts.

Additional Context:

- Geopolitical Tensions: Global tensions, including trade disputes and geopolitical conflicts, continue to impact market dynamics. Investors are watching for any developments that could influence economic stability and market performance.

- Sector Performance: Specific sectors, such as technology and energy, are experiencing varied impacts from global trends and economic data. Market participants are analyzing sector-specific performance to identify investment opportunities.

- European markets are expected to open higher as investors await critical information from the Federal Reserve. The upcoming minutes release and Powell’s speech at Jackson Hole are anticipated to provide valuable insights into the Fed’s monetary policy, influencing market trends and investor sentiment. The interplay between U.S. economic data, Fed policy, and global market conditions will be crucial in shaping future market movements.