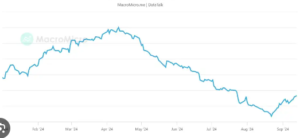

LONDON — European stock markets are set for a robust start this week, bolstered by the U.S. Federal Reserve’s unexpected decision to slash interest rates by 50 basis points, its most aggressive cut in four years. This move has electrified global markets, with major European indices expected to open significantly higher on Monday.

The U.K.’s FTSE 100 is anticipated to climb 46 points to 8,245, while Germany’s DAX is set to increase by 87 points, reaching 18,810. France’s CAC 40 is forecasted to rise by 40 points to 7,359, and Italy’s FTSE MIB is projected to soar by 169 points to 33,821, according to IG data.

Fed’s Rate Cut Sparks Global Rally

The Federal Reserve’s decisive action to reduce the benchmark interest rate by half a percentage point has sent ripples through financial markets. This strategic move, aimed at countering economic headwinds and supporting growth, has revived investor sentiment. The Fed’s rate cut is expected to inject much-needed liquidity into the market, reduce borrowing costs, and bolster consumer confidence, providing a cushion against potential economic downturns.

Asian markets mirrored the positive trend overnight, buoyed by favorable monetary policy updates from Japan and China. The optimism surrounding the Fed’s decision suggests that central banks globally are committed to fostering economic stability and growth.

Focus Shifts to Key Economic Data

In Europe, attention is now turning to the release of preliminary purchasing managers’ index (PMI) data from France, Germany, and the U.K. These indicators will be critical in assessing the health of the region’s manufacturing and services sectors as the third quarter progresses. Strong PMI readings could further enhance market momentum and solidify the outlook for economic recovery.

U.S. Markets Maintain Momentum

Across the Atlantic, U.S. markets remain buoyant. Dow futures showed resilience after the index surged to a record high last week, fueled by the Fed’s rate cut. This marked a pivotal moment as investors embraced the central bank’s proactive stance. Analysts are optimistic that the Fed’s aggressive policy shift could sustain upward momentum in equities, particularly in sectors such as technology and financial services, which stand to benefit from lower interest rates and improved lending conditions.

Investment Opportunities Amid Market Optimism

For investors, the current climate presents a wealth of opportunities. Experts suggest that sectors like technology and financial services are poised to outperform as a result of enhanced liquidity and favorable borrowing conditions. Additionally, strategic investments in defensive stocks and high-growth companies could provide substantial returns as markets adapt to the new monetary environment.

Outlook for European Markets

As European markets open, all eyes will be on key economic data and earnings reports. Investors are keen to gauge the effectiveness of monetary policies and their impact on the region’s economic trajectory. With the Fed’s bold move setting the tone, European markets are expected to maintain a positive outlook, supported by strong corporate earnings and encouraging economic indicators.

Overall, the Fed’s rate cut has set a promising stage for European stocks, creating a wave of optimism that is likely to sustain in the coming weeks. Investors and analysts alike will be closely monitoring further developments to navigate this dynamic and evolving market landscape.

European markets are experiencing a positive trend as they respond to the U.S. Federal Reserve’s recent interest rate cut. The FTSE 100 rose by 0.9%, and Germany’s DAX and France’s CAC 40 also saw significant gains. Analysts are speculating that this dovish shift from the Fed could prompt the European Central Bank to ease its restrictive stance more rapidly in 2025. Additionally, the Bank of England maintained its rates at 5.0%, indicating a cautious approach toward future cuts amid global economic adjustments.