Keywords: European stocks, global markets, US economic data, jobless claims, payroll numbers, central bank policy, Stoxx 600 index, US futures, MSCI Asia-Pacific Index, Japan Topix Index, US dollar, market volatility, investor sentiment.

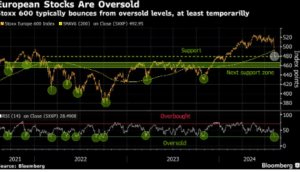

Summary: European stocks tumbled as investor attention shifted back to US economic data, particularly jobless claims, following disappointing payroll numbers. The decline in European markets extended the recent wave of volatility affecting global financial markets, driven by concerns over central bank policy decisions.European stocks experienced a significant drop, prolonging the volatility that has gripped global markets over the past few days. The Stoxx 600 index, a key benchmark for European equities, reversed much of its previous gains, with technology and mining shares leading the decline. This downturn reflects growing uncertainty among investors as they grapple with the potential implications of upcoming central bank policy decisions.

US Futures Struggle as Economic Data Remains in Focus

In the United States, futures contracts struggled to hold onto modest gains after Wall Street suffered losses overnight. Investors are increasingly focused on US jobless claims data, especially after recent payroll numbers came in weaker than expected. The US labor market’s health is seen as a critical factor that could influence the Federal Reserve’s next moves regarding interest rates.

Asia-Pacific Markets Follow Suit

The ripple effect of economic concerns in the US and Europe extended to Asia, where MSCI’s Asia-Pacific Index also dropped. Japan’s Topix Index, in particular, saw another decline after a brief recovery from earlier losses. The ongoing uncertainty in global markets has led to cautious sentiment among Asian investors as well.

US Dollar Weakens Against Major Currencies

Adding to the market’s mixed signals, the US dollar weakened against other major currencies. The dollar’s performance is closely watched as it often reflects investor confidence in the US economy. A weaker dollar can indicate concerns about economic growth and the potential for a shift in central bank policy.

Central Bank Policy Debates Intensify

The ongoing debate around central bank policies, particularly in the US, continues to be a focal point for investors. With inflation concerns and economic data painting a complex picture, markets are on edge as they try to anticipate the actions of central banks in the coming months. Any shifts in interest rates or monetary policy could have significant implications for global markets.

Investor Sentiment Remains Fragile

The combination of disappointing US economic data, potential central bank policy changes, and global market volatility has created an environment of uncertainty. Investors are closely monitoring economic indicators and central bank communications for any signs of what may come next.

As global markets continue to react to economic data and the potential paths of central bank policies, volatility remains a defining feature of the current financial landscape. Investors should brace for continued fluctuations as the debate over central bank actions, particularly in the US, intensifies in the coming weeks.

Sector-Specific Losses: Technology and Mining Under Pressure

The technology sector was one of the hardest hit, as rising bond yields and the prospect of higher interest rates continue to weigh on high-growth stocks. Mining shares also declined, reflecting broader concerns about global demand for raw materials amid slowing economic activity. The sell-off in these sectors highlights the market’s sensitivity to changes in economic data and interest rate expectations.

US Futures Struggle as Focus Shifts to Jobless Claims

In the US, futures markets showed signs of strain, with contracts struggling to hold onto modest gains. This followed a tough session on Wall Street, where major indices closed lower. Investors are particularly focused on weekly jobless claims data, which is being closely watched after the release of weaker-than-expected payroll numbers. The labor market’s performance is crucial, as it could influence the Federal Reserve’s approach to interest rates in the coming months.

Impact on the US Labor Market: A Key Indicator for Investors

The recent payroll report, which showed fewer jobs added than anticipated, has heightened concerns about the US economy’s strength. This has placed even more importance on jobless claims data, as investors seek to gauge whether the labor market is cooling off. A weaker labor market could prompt the Federal Reserve to reconsider its stance on interest rate hikes, which has been a key driver of market volatility.

Asia-Pacific Markets Reflect Global Sentiment

The downturn in Europe and the US also reverberated across Asia, with the MSCI Asia-Pacific Index declining as investor sentiment soured. Japan’s Topix Index was among the notable losers, falling for a second consecutive session despite a brief recovery earlier in the day. The weakness in Asian markets underscores the global nature of the current economic concerns, as investors in the region react to developments in the US and Europe.

Central Bank Policy: The Looming Question for Investors

The ongoing debate over central bank policies, particularly in the US and Europe, remains a major source of uncertainty for investors. With inflation still above target in many regions and economic data sending mixed signals, central banks face a difficult balancing act. The potential for further interest rate hikes, or a pause in tightening cycles, could have significant implications for financial markets.

European Central Bank (ECB) and Bank of England (BoE) Outlook

In Europe, the European Central Bank (ECB) and the Bank of England (BoE) are also under scrutiny as they navigate their respective economic challenges. Both central banks have been raising rates to combat inflation, but there are growing concerns that continued tightening could push economies into recession. Investors are closely watching for any signals from these institutions regarding their future policy paths.

Volatility and Investor Sentiment: A Fragile Balance

The current market environment is marked by heightened volatility, as investors react to every new piece of economic data and central bank communication. Sentiment remains fragile, with many market participants adopting a cautious approach amid the uncertainty. The potential for sudden shifts in market direction remains high, particularly as central banks continue to play a pivotal role in shaping the economic outlook.