Following a dismal earnings report and a regulatory filing that raised questions about the company’s prior financial statements, shares of electric vehicle startup Fisker plummeted on Tuesday.

The stock of the company dropped by over 18% to close at $3.34 per share.

On Monday afternoon, Fisker released its third-quarter earnings, and the results fell short of Wall Street’s expectations. $71.8 million in revenue and a $91 million net loss, or 27 cents per share, were below the Street’s forecasts.

There was however more. Following the abrupt departure of its chief accounting officer in October, Fisker said in a Monday night regulatory filing following its earnings report that it “determined that it has material weaknesses in the Company’s internal control over financial reporting.”

It stated that these flaws will cause a delay in its quarterly 10-Q filing.

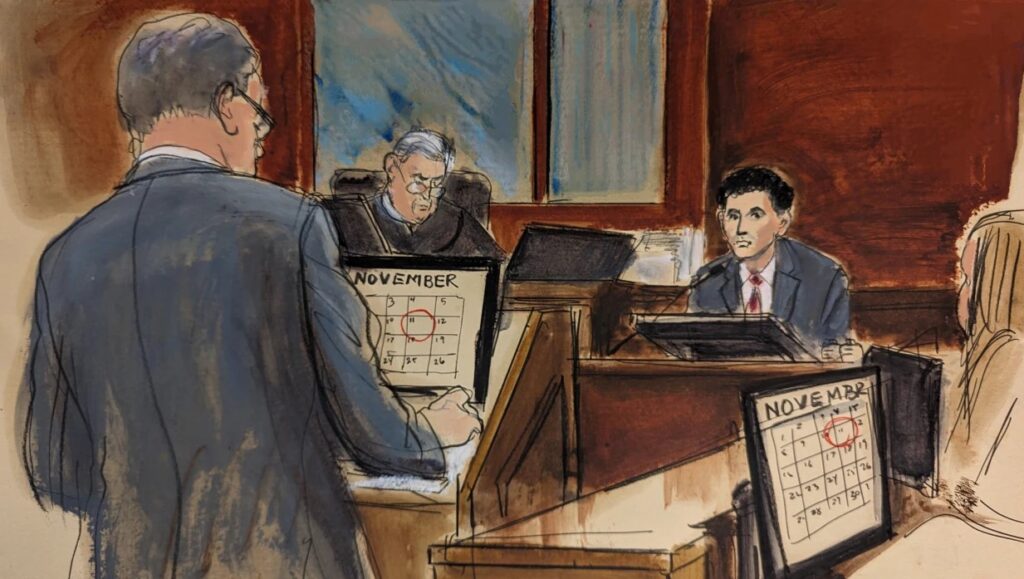

Originally, Fisker was going to release its third-quarter results ahead of the opening of U.S. markets on November 8. However, it abruptly withdrew its report early that morning, citing “delayed the completion of the financial statements and related disclosures” as the reason for the departure of its chief accounting officer on October 27 and the appointment of a new one on November 6.

The company has not yet provided an explanation for the departure of its former CFO or the delay in releasing its earnings report. However, CFO Geeta Gupta-Fisker stated during the earnings call on Monday that the third quarter was “very complex” due to the company’s global ramp-up.