–

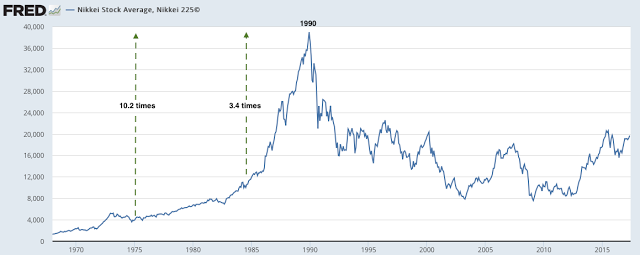

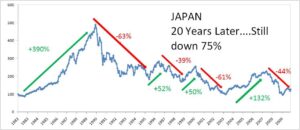

Nikkei Average Down 3%: Japan’s stock market rally has slowed since mid-July, with the benchmark Nikkei Stock Average down 3% as professional investors focus on the weak yen’s adverse impact.

Weak Yen Concerns: The yen’s slide versus the dollar helped fuel the rally in Japanese stocks last year and into 2024, but investors now worry that the yen’s weakness could harm consumers and smaller companies .

Decline After U.S. Consumer Price Data: The Nikkei index has fallen 6% and the Topix has lost around 5% since the release of U.S. consumer price data on July 11, which showed inflation unexpectedly fell in June .

Impact on Japanese Tech Stocks: Selling mounted for Japanese tech stocks, with Tokyo Electron down 5.6% and Advantest falling 8.3%  .

.

Commodity Trading Advisors’ Role: Commodity trading advisors (CTAs) began unwinding their long positions when the Nikkei hit 40,000, selling around 400 billion yen ($2.6 billion) worth of long positions in Japanese equities last week .

Yen’s Depreciation and Japanese Equities: The yen’s depreciation could push Japanese equities lower, with domestic factors like corporate governance reforms and stock buybacks responsible for lifting Japanese stocks this year .Influence of China’s Politburo Meeting: China’s Politburo meeting later this month is expected to influence Japanese equities, with investors likely to rotate capital out of China and into Japan if Beijing fails to introduce expected economic stimulus measures .