Keywords: Moderna cost-cutting, Moderna product pipeline, respiratory vaccines, RSV vaccine, COVID-19 and flu shot, personalized cancer vaccine, biotech innovation, Stéphane Bancel, mRNA-1010, pharmaceutical industry trends.

New York – In a bold move to redefine its future, Moderna announced a sweeping $1.1 billion cost-cutting initiative, targeting 2027 as a pivotal year for financial transformation. As the biotech giant navigates the post-COVID era, it’s sharpening its focus on innovation with plans to launch 10 new groundbreaking products by 2027. This shift comes after the rapid decline of its COVID-19 vaccine business, forcing the company to realign its strategy.

Key Takeaways: Moderna’s New Vision

- $1.1 Billion in Cost Reductions: Moderna aims to slash expenses, bringing its R&D budget down from $4.8 billion in 2024 to a projected $3.6-$3.8 billion by 2027.

- 10 New Products by 2027: The biotech firm is planning to release a portfolio of innovative vaccines and therapies, targeting respiratory viruses, cancer, and rare diseases.

- Deprioritizing Low-Priority Projects: Moderna will pause and discontinue less critical R&D programs to focus resources on high-impact products.

- Innovative Products Set to Lead Moderna’s Future

Moderna is primed to revolutionize the healthcare landscape with a slew of new vaccines and therapeutics in the pipeline:

- Next-Generation Respiratory Vaccines:

- RSV Vaccine: Moderna’s RSV vaccine for high-risk adults aged 18-59 has shown exceptional results in late-stage trials. It’s slated for FDA approval by 2025 using a priority review voucher, reducing the typical review period from 10 to 6 months.

- Combination COVID-19 and Flu Vaccine: Moderna plans to file for U.S. approval of its combination COVID-19 and flu shot by year’s end, capitalizing on the success of its earlier vaccines.

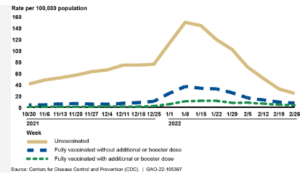

- New COVID-19 Shot: A more effective version of its COVID-19 vaccine is also part of the company’s evolving product line.

- Non-Respiratory Breakthroughs:

- Cancer Vaccines: Moderna is advancing its personalized cancer vaccine, developed in collaboration with Merck. This therapy is being tested in combination with Merck’s Keytruda and is undergoing a Phase 3 trial for skin cancer.

- Norovirus Vaccine: Moderna’s norovirus vaccine, targeting the highly contagious stomach virus, will enter Phase 3 trials imminently. This product could launch as early as 2026, addressing a critical gap in the market for norovirus treatments.

- Positive Momentum in Late-Stage Trials

At its annual R&D Day, Moderna presented encouraging data from its late-stage trials. The company revealed that its RSV vaccine for younger, high-risk adults (18-59) met key efficacy targets, with no significant safety concerns. Moderna is now positioning this vaccine to fill a crucial gap in the market, as no other RSV shot has been approved for this demographic.

Additionally, Moderna’s standalone flu vaccine, mRNA-1010, outperformed existing flu shots in boosting immune responses in older adults during Phase 3 trials. The company is confident this flu vaccine will be a significant player in the seasonal vaccine market.

Revenue Growth and Future Projections

Moderna’s financial outlook is equally ambitious. The company expects 2025 revenues to reach $2.5 billion to $3.5 billion, with a compounded annual growth rate exceeding 25% from 2026 to 2028. This growth will be fueled by its new product launches and its ability to bring drugs through development with a success rate six times higher than the industry average.

CEO Stéphane Bancel emphasized the importance of pacing R&D investment: “Our team’s success in advancing drugs from Phase 1 to Phase 3 is unprecedented. However, we must be strategic in how we allocate resources to maintain this momentum while delivering maximum value.”

Strategic Shift in R&D Investments

As part of its restructuring, Moderna will deprioritize certain projects, particularly those related to latent viruses, where the potential for large-scale impact is less immediate. By focusing on products with the highest commercial and therapeutic potential, Moderna is positioning itself for sustained long-term growth.

Despite the positive outlook, Moderna has faced challenges, particularly with its cancer vaccine. The FDA has yet to approve an accelerated pathway for its personalized cancer shot, but Bancel remains optimistic: “We’re in continuous discussions with regulators and are committed to gathering more data to support our application.

Moderna’s aggressive cost-cutting and focused product strategy mark a new chapter in the company’s evolution beyond its COVID-19 success. With innovative vaccines targeting RSV, flu, and norovirus, as well as promising cancer therapies, Moderna is set to remain at the forefront of the biotech industry. Investors and healthcare professionals alike are watching closely as the company positions itself for a future defined by high-impact medical advancements

.

.

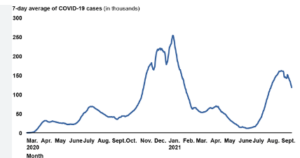

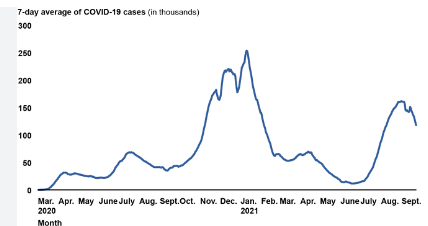

Moderna has announced a significant strategic shift as it looks beyond its COVID-19 vaccine business. The company plans to cut $1.1 billion in costs by 2027 and simultaneously launch 10 new products. These include respiratory vaccines and treatments for cancer and rare diseases. This change comes in response to a sharp decline in COVID-19-related sales, which heavily impacted their financial performance in 2023.

Moderna is refocusing its research and development (R&D) efforts, cutting costs by scaling back some projects while advancing others. Its new product pipeline is promising, with recent positive results in late-stage trials for vaccines against respiratory syncytial virus (RSV) and standalone flu shots for older adults. The company aims to reduce its R&D expenses to around $3.6 billion by 2027, down from $4.8 billion(

Despite challenges, Moderna’s long-term strategy includes the development of combination vaccines, like one targeting both COVID-19 and the flu. Additionally, their partnership with Merck aims to advance personalized cancer vaccines. Moderna expects significant revenue growth between 2026 and 2028, projecting a 25% compound annual growth rate, driven by new product launches