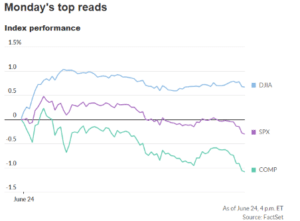

June 24, 2024 – The Nasdaq Composite (^IXIC) saw a notable decline of over 190 points, representing a decrease of nearly 1.10% during Monday’s trading session. In contrast, the Dow Jones Industrial Average (^DJI) surged ahead by 260 points. Nvidia (NVDA) extended its downturn for the third consecutive session, influencing the performance of the S&P 500 (^GSPC).

Market Insights on Market Domination Overtime :

On the latest episode of Market Domination Overtime, hosts Julie Hyman and Josh Lipton engaged in a discussion with Invesco Global Market Strategist Brian Levitt. The conversation centered on understanding the resilience of the broader market amidst Nvidia’s recent challenges. They explored factors driving market momentum despite sector-specific fluctuations.

Arm Holdings Joins Nasdaq 100 :

Arm Holdings (ARM) achieved a significant milestone by joining the Nasdaq 100 (^NDX) on Monday. Since its public debut in September 2023, Arm’s shares have soared by nearly 140%. CEO Rene Haas provided insights into this accomplishment and discussed Arm’s strategic outlook amid evolving market conditions.

This update provides a comprehensive analysis of major market indices’ performance and the impact of key companies like Nvidia and Arm Holdings on market dynamics.

Stock Market Today:

Dow ends 260 points higher, Nvidia slips into correction territory.(Last Updated: Jun 24, 2024 at 4:29 pm ET)

| S&P 500 spx (s&p US) 5,447.87-16.75-0.31%▼ |

| DJI ADJIA (Dow Jones Global) 39,411.21260.880.67%▲ |

| Nasdaq Comp (NASDAQ) 17,496.82-192.54-1.09%▼ |

| U.S. 10 YrBx (XTUP) 4.24%0.01▲ |

| US Dollar Index (DXY) 105.46-0.02-0.02%▼ |

| Bitcoin USD BTCUSD(KRAKEN) 61057.501588.702.67%▲ |

| Crude Oil (NYM) $81.64 USD0.010.01%▲ |

| Gold Continuous Contract (NYM) $2337.40 USD-7.00-0.30%▼ |

Nvidia Faces Decline After Brief Reign as Most Valuable Company

Following its recent stint as the world’s most valuable company, Nvidia has experienced a three-day decline, amounting to a 13% decrease from its peak.

Nvidia CEO Jensen Huang makes a speech at an event at COMPUTEX forum in Taipei, Taiwan June 4, 2024.

Big Fall on Monday:

This Monday, Nvidia saw its second big fall this year, dropping 6.7% to $118.11. This led to a wider fall in stocks for companies making chips and tech linked to the field of artificial intelligence (AI).

Effects on Other Firms:

- Super Micro Computer, which uses Nvidia’s AI chips in its servers, went down by 8.7%.

- Dell, which also works in the AI space, fell 5.2%.

- The chip maker Arm saw a 5.8% drop.

- Big chip firms like Qualcomm and Broadcom also saw losses, falling 5.5% and 3.7% respectively.

Market Reaction and Investor Sentiment:

These firms have seen big jumps in value lately, driven by hope in AI growth chances. Nvidia’s market worth almost tripled in the past year, even after a drop, at one point getting ahead of Apple and Microsoft last week before falling back a bit. On Monday, Nvidia was among the biggest drops in the S&P 500.

These firms have seen big jumps in value lately, driven by hope in AI growth chances. Nvidia’s market worth almost tripled in the past year, even after a drop, at one point getting ahead of Apple and Microsoft last week before falling back a bit. On Monday, Nvidia was among the biggest drops in the S&P 500.

Future Outlook:

Now that Nvidia has launched these new GPUs, there’s nothing stopping it from launching the new generation called “Blackwell. The company itself plans on releasing its new generation AI processors called Gaucho by the end of this year.