Keywords: Nvidia stock, semiconductor industry, AI boom, chip stocks, Nvidia market cap, Nvidia revenue, Intel AI processors, Broadcom AI chips, Nvidia data center chips, VanEck Semiconductor ETF, Nvidia sales growth.

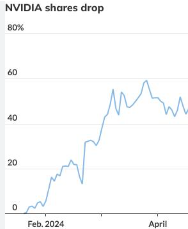

Nvidia’s stock took a significant hit on Tuesday, dropping by 9.5%, which wiped out nearly $300 billion in market capitalization. This sharp decline had a profound impact on the entire semiconductor industry, leading to the worst day for chip stocks since March 2020.

Nvidia’s Steep Decline and Market Impact

On Tuesday, Nvidia experienced a staggering 9.5% drop in its stock price, resulting in a nearly $300 billion reduction in its market cap. This plunge sent shockwaves through the semiconductor industry, dragging down other major chip stocks:

- Intel: The tech giant saw its shares fall by nearly 8%.

- Marvell Technology: The stock dropped by 8.2%.

- Broadcom: Experienced a decline of about 6%.

- AMD: Shares were down 7.8%.

- Qualcomm: The company’s stock decreased by nearly 7%.

The broader market also struggled, with the VanEck Semiconductor ETF (SMH), an index tracking semiconductor stocks, plummeting by 7.5%, marking its worst performance since the pandemic-induced crash in March 2020.

Underlying Factors Behind the Drop

The market’s downturn was exacerbated by the release of the ISM manufacturing index for August, which came in below consensus expectations. This disappointing data fueled concerns about the strength of the U.S. economy. However, some analysts believe it could increase the chances of the Federal Reserve cutting interest rates in the near future.

Nvidia’s Role in the AI Boom and Chip Sector Growth

Over the past year, chip stocks have enjoyed substantial gains, driven by optimism surrounding the artificial intelligence (AI) boom. Companies are expected to ramp up spending on semiconductors and memory to support the growing computational demands of AI applications. Nvidia has been a key player in this trend, dominating the market for AI data center chips. Despite Tuesday’s plunge, Nvidia’s stock remains up 118% for the year, underscoring its pivotal role in the AI-driven growth of the semiconductor industry.

Nvidia’s Recent Financial Performance

Last week, Nvidia reported impressive financial results for the quarter ending in July, with revenue reaching $30 billion, surpassing Wall Street’s already elevated expectations. The company’s data center business, which includes AI processors, saw a 154% year-over-year increase in revenue. This surge was driven by major cloud and internet giants that purchase billions of dollars worth of Nvidia chips each quarter.

Looking ahead, Nvidia has forecasted 80% sales growth for the current quarter. However, some investors found this projection disappointing, leading to a brief dip in the stock prices of companies that supply Nvidia with memory and other components.

Other Developments in the Semiconductor Industry

- Intel: The company announced the launch of new laptop processors designed to run AI programs directly on the device, reducing the need for cloud-based servers.

- Broadcom: The company continues to collaborate with large enterprises to develop custom AI chips. Broadcom is set to report its third-quarter earnings on Thursday.

Nvidia’s recent plunge serves as a stark reminder of the volatility in the semiconductor sector, even as the industry remains a crucial player in the ongoing AI revolution.

As Nvidia navigates the challenges and opportunities of the AI-driven market, its performance will continue to be closely watched by investors and industry analysts alike. Despite the recent setback, Nvidia remains a dominant force in the semiconductor industry, and its future developments will likely have a significant impact on the broader market.

1. Historical Stock Performance:

- Nvidia’s Year-to-Date Performance: Although Nvidia’s stock plunged by 9.5%, it’s still up 118% for the year. Compare this performance with previous years to highlight the overall growth trajectory.

- Competitor Comparison: Provide a chart or table comparing Nvidia’s stock performance with competitors like AMD, Intel, and Broadcom over the past year. This will help contextualize Nvidia’s position in the market.

2. Industry Trends:

- AI and Semiconductor Demand: Dive deeper into the driving forces behind the AI boom and its impact on semiconductor demand. Include forecasts from industry analysts on the expected growth of the AI market and how it will continue to drive semiconductor sales.

- Supply Chain Challenges: Discuss any ongoing supply chain issues in the semiconductor industry, such as chip shortages, which could be influencing stock prices and market sentiment.

3. Financial Metrics:

- Revenue and Profit Margins: Include more detailed financial data, such as Nvidia’s revenue growth over the past few quarters, profit margins, and how these metrics compare to industry averages.

- R&D Spending: Highlight Nvidia’s investment in research and development, particularly in AI and GPU technology, and compare it with other leading chipmakers.

4. Expert Opinions and Analyst Ratings:

- Market Analysts’ Views: Include quotes or ratings from financial analysts on Nvidia’s stock. Are they still bullish despite the recent plunge? What are their price targets for the next 6-12 months?

- Impact of Federal Reserve Policies: Discuss how potential Federal Reserve interest rate cuts might affect Nvidia and the broader tech market. Include opinions from economists or financial experts.

5. Broader Economic Context:

- ISM Manufacturing Index Impact: Explain in more detail how the ISM manufacturing index affects tech stocks and why the recent figures have caused concern.

- Global Economic Indicators: Expand on how global economic conditions, such as inflation, trade tensions, or geopolitical risks, are influencing the semiconductor industry.

6. Company-Specific Developments:

- Nvidia’s Product Pipeline: Provide more information on upcoming Nvidia products, such as new GPU launches or AI innovations. How do these products compare to what competitors are offering?

- Partnerships and Acquisitions: Mention any recent partnerships, acquisitions, or strategic alliances Nvidia has formed to strengthen its position in the AI and semiconductor markets.

7. Investor Sentiment:

- Investor Reactions: Include data on trading volume during the plunge and any significant changes in institutional holdings. Are major funds buying or selling Nvidia stock?

- Sentiment Analysis: Consider incorporating sentiment analysis from social media or financial forums to gauge how retail investors are reacting to the news.

8. Visual Aids:

- Charts and Graphs: Use charts to visualize Nvidia’s stock performance, revenue growth, and comparisons with competitors. Infographics can also illustrate key points like the AI market’s growth or Nvidia’s product roadmap

.

.