Keywords: Pakistan external financing, IMF Extended Fund Facility, Pakistan debt challenges, Pakistan credit rating, Middle Eastern banks, Pakistan borrowing costs, Pakistan foreign assistance, Pakistan fiscal discipline, Pakistan debt repayment.

ISLAMABAD, August 29, 2024 — As Pakistan continues its negotiations with the International Monetary Fund (IMF) for the approval of a $7 billion Extended Fund Facility (EFF), the country faces mounting external financial commitments and the challenge of securing favorable terms from international lenders. Governor of the State Bank of Pakistan, Jameel Ahmed, revealed in a recent interview that Pakistan aims to raise up to $4 billion from Middle Eastern commercial banks. Additionally, the country is at an advanced stage of securing $2 billion in external financing, a critical requirement for the IMF Board’s approval of the EFF program, following the staff-level agreement reached on July 12, 2024.

Rising Financial Needs and Budgetary Concerns

Governor Ahmed’s comments highlight an increase in Pakistan’s external borrowing needs. The budget initially earmarked $3.779 billion from commercial banks abroad, but this figure has now been rounded up to $4 billion, signaling a $221 million rise in financial requirements just two months into the fiscal year. This increase underscores the ongoing fiscal challenges Pakistan faces, particularly as it seeks to secure funds under increasingly difficult conditions.

Credit Ratings and Borrowing Costs

Pakistan’s ability to secure external financing has been hampered by its poor credit ratings from major international rating agencies. Although Fitch upgraded Pakistan’s rating from CCC- to CCC+ following the IMF staff-level agreement, and Moody’s recently improved the country’s rating from Caa3 to Caa2, these upgrades remain within the lowest spectrum of speculative-grade ratings. Standard and Poor’s has maintained Pakistan’s CCC+ rating since December 2022.

These modest improvements in credit ratings, while positive, may not significantly reduce the high interest rates that commercial banks are likely to demand. The country’s high credit risk continues to drive up borrowing costs, making it difficult for Pakistan to access funds on favorable terms.

Middle Eastern Banks and Competitive Rates

The governor indicated that Middle Eastern banks are expected to provide the necessary funds, although it remains uncertain whether these banks will offer more competitive rates compared to their Western counterparts. While Pakistan has historically relied on financial support from friendly countries, including Middle Eastern nations, commercial banks—regardless of their location—operate primarily on economic principles, focusing on risk management and profitability.

Debt Repayment Challenges

The scale of Pakistan’s external debt repayment obligations is daunting. The country faces a total repayment requirement of $26.2 billion in the current fiscal year. Of this, $12.3 billion in commitments have been received, with $4 billion expected to be rolled over. This leaves a substantial funding gap that Pakistan must bridge to meet its debt obligations and secure IMF approval.

Foreign Assistance and Fiscal Discipline

According to the Economic Affairs Division (EAD), Pakistan received $436.39 million in foreign assistance during the first month of the ongoing fiscal year, a mere 0.8% of the total budgeted $19.39 billion for the year. The bulk of this assistance came from the International Development Association (IDA) at $111.88 million, followed by China ($96.76 million), the Asian Development Bank (ADB) ($54.05 million), and the International Bank for Reconstruction and Development (IBRD) ($20.54 million). To gain the IMF’s confidence and secure the EFF, these inflows must increase significantly.Pakistan is trapped in a debt vortex, and without substantial reductions in current expenditures and significant improvements in tax collection, the country risks deepening its financial woes. The reliance on external borrowing to manage fiscal deficits is not a sustainable long-term strategy. To break free from this cycle, Pakistan must adopt rigorous fiscal discipline, enhance revenue generation with equitable tax measures, and pursue structural economic reforms. Only through such measures can Pakistan hope to achieve economic stability and regain the confidence of international lenders.

Historical Debt Accumulation

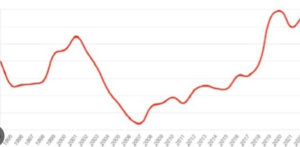

Debt Growth Over the Years: Pakistan’s external debt has grown significantly over the past decade. As of 2024, the country’s total external debt is estimated to be around $130 billion. This growth has been driven by persistent fiscal deficits, reliance on external borrowing to finance infrastructure projects, and the need to stabilize the currency through foreign exchange reserves.

Debt Composition: Pakistan’s external debt is a mix of multilateral loans from institutions like the IMF, World Bank, and Asian Development Bank, bilateral loans from countries such as China, Saudi Arabia, and the UAE, and commercial loans from international banks. The high proportion of short-term commercial debt has increased Pakistan’s vulnerability to global financial market conditions.

Impact of CPEC: The China-Pakistan Economic Corridor (CPEC) has been a significant contributor to Pakistan’s external debt. While CPEC-related investments have improved infrastructure and energy supply, the associated debt obligations have added to the country’s financial burden. As of 2024, CPEC-related debt accounts for a substantial portion of Pakistan’s bilateral debt, primarily owed to China.

Economic Challenges and IMF Engagement

Inflation and Currency Depreciation: Pakistan has been grappling with double-digit inflation rates, which have eroded purchasing power and increased the cost of living. Inflation has been driven by factors such as rising global oil prices, currency depreciation, and supply chain disruptions. The Pakistani Rupee has depreciated significantly against major currencies, further exacerbating the country’s external debt servicing costs.

Fiscal Deficit: Pakistan’s fiscal deficit remains a critical challenge, hovering around 7-8% of GDP in recent years. High government spending, low tax revenue, and subsidies on energy and food have contributed to the widening deficit. The IMF has repeatedly emphasized the need for fiscal consolidation, including reducing subsidies and increasing tax revenue, as conditions for its financial support.

Structural Reforms: The IMF has called for structural reforms in Pakistan’s economy, particularly in the energy sector, tax administration, and public sector enterprises. These reforms are essential for improving fiscal discipline, reducing inefficiencies, and enhancing economic productivity. However, political instability and resistance from vested interests have slowed the pace of reform implementation.

International Relations and Geopolitical Factors

- Geopolitical Dynamics: Pakistan’s geopolitical position has influenced its economic relations with key allies and international financial institutions. The country’s strategic importance, particularly in the context of regional security and counterterrorism efforts, has led to financial support from countries like the United States, Saudi Arabia, and China. However, changing geopolitical dynamics, such as shifting alliances and global power competition, have added complexity to Pakistan’s foreign relations and economic dependencies.

- China’s Role: China has emerged as Pakistan’s largest bilateral creditor, providing substantial financial support through loans, grants, and investments under the CPEC initiative. While this has helped Pakistan address infrastructure gaps, it has also raised concerns about debt sustainability and dependency on Chinese financing. The IMF and other Western institutions have expressed concerns over the transparency and terms of Chinese loans.

- Saudi Arabia and UAE Support: Saudi Arabia and the UAE have been critical sources of financial support for Pakistan, particularly in the form of oil supply on deferred payment and cash deposits in Pakistan’s central bank to bolster foreign exchange reserves. These countries have also provided rollovers of existing loans, helping Pakistan manage its short-term financing needs.

- Financial Market

- Global Interest Rates: The global economic environment, particularly the trend of rising interest rates in advanced economies, has made borrowing more expensive for emerging markets like Pakistan. The U.S. Federal Reserve and other central banks have increased interest rates to combat inflation, leading to higher borrowing costs for countries with low credit ratings. This has added pressure on Pakistan to secure funds at competitive rates.

- Sovereign Bond Market: Pakistan has faced challenges in accessing international bond markets due to its low credit rating and high perceived risk. In recent years, the government has struggled to issue Eurobonds and Sukuk bonds, with investors demanding high yields due to concerns over Pakistan’s economic stability. The lack of access to bond markets has increased reliance on bilateral and multilateral loans.

- Foreign Direct Investment (FDI): Pakistan’s FDI inflows have been relatively low compared to other emerging markets. Political instability, security concerns, and a challenging business environment have deterred foreign investors. Improving FDI inflows is crucial for reducing reliance on debt and boosting economic growth.

- Economic Outlook and Strategic Recommendations

- Debt Sustainability Analysis: International financial institutions, including the IMF, have conducted debt sustainability analyses for Pakistan, highlighting the need for prudent fiscal management and structural reforms. These analyses suggest that without significant reforms, Pakistan’s debt burden could become unsustainable, leading to a potential default scenario.

- Diversification of Financing Sources: To reduce dependency on high-cost commercial loans, Pakistan needs to diversify its financing sources. This includes exploring new markets for issuing bonds, engaging with non-traditional lenders, and attracting more FDI. Strengthening economic ties with regional partners and participating in initiatives like the Belt and Road Initiative (BRI) could also open new avenues for financing.

- Enhancing Domestic Resource Mobilization: Improving tax collection is essential for reducing Pakistan’s fiscal deficit and reliance on external borrowing. The government needs to implement comprehensive tax reforms, including broadening the tax base, reducing tax evasion, and improving tax administration. Equitable tax policies that ensure horizontal and vertical equity are crucial for gaining public support and enhancing revenue generation.

- Long-term Economic Reforms: Sustainable economic growth requires long-term reforms in key sectors, including agriculture, industry, and services. The government should focus on improving productivity, enhancing competitiveness, and creating a conducive environment for business and innovation. Reforms in education, health, and social protection are also critical for building human capital and reducing poverty.

- Improving Governance and Transparency: Addressing governance issues, such as corruption, bureaucratic inefficiencies, and lack of transparency, is vital for improving investor confidence and ensuring the effective use of financial resources. Strengthening institutions and promoting accountability are key steps towards achieving long-term economic stability.