PDD Holdings, the parent company of popular e-commerce platforms Temu and Pinduoduo, saw its shares plummet by nearly 29% on Monday, marking the largest single-day drop since its Nasdaq debut. The dramatic sell-off followed the release of the company’s second-quarter earnings, which fell short of analysts’ expectations.

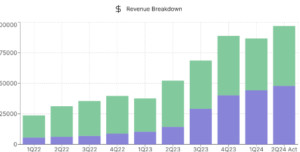

Earnings Miss: PDD Holdings reported Q2 revenue of 97.06 billion yuan ($13.6 billion), up 86% year-over-year but below the anticipated $14.034 billion.

Profit Surge: Despite the revenue miss, the company’s operating profit soared 156% to 32.56 billion yuan, with attributable income increasing 144% to 32.01 billion yuan.

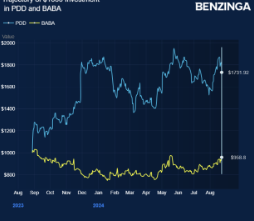

Market Reaction: Shares tumbled 28.57%, with analysts suggesting the sell-off was an overreaction, labeling it as “too large a correction.”

Leadership Caution: Company leaders issued cautious statements about future growth, contributing to investor jitters.

Earnings Miss Leads to Massive Sell-Off

PDD Holdings reported second-quarter revenue of 97.06 billion yuan ($13.6 billion), an 86% increase from the same period last year. However, this figure missed Wall Street’s expectations of $14.034 billion, leading to a sharp decline in the company’s stock price. By the close of trading, shares had dropped 28.57%, the most significant one-day loss since PDD’s Nasdaq listing.

Despite the revenue miss, PDD Holdings posted strong profitability metrics. The company’s operating profit surged 156% to 32.56 billion yuan, while attributable income jumped 144% year-over-year to 32.01 billion yuan. These figures indicate robust underlying business performance, even as the top-line numbers fell short.

Analyst: Stock Drop Is an Overreaction

Shaun Rein, founder and managing director of the China Market Research Group, believes the nearly 30% drop in PDD Holdings’ stock price is an overreaction by the market. Speaking on CNBC’s “Street Signs Asia,” Rein said, “The panic was overblown last night, and this could be a good opportunity for investors to buy into the stock.”

Rein pointed out that Pinduoduo, PDD’s flagship e-commerce platform, continues to grow significantly, despite missing analysts’ expectations. “Pinduoduo is still growing 20%, 30%, and generating billions of dollars in revenue,” he noted, suggesting that the stock remains a solid investment despite the recent dip.

Leadership’s Cautious Outlook Adds to Investor Concerns

The market’s reaction was also fueled by cautious statements from PDD Holdings’ leadership. In the earnings release, Lei Chen, chairman and co-CEO, acknowledged the company’s progress but warned of potential challenges ahead. “We are prepared to accept short-term sacrifices and a potential decline in profitability as we invest heavily in areas like trust and safety, and improving our merchant ecosystem,” Chen said.

Jun Liu, PDD’s Vice President of Finance, echoed these sentiments, stating that “revenue growth will face pressure due to intensified competition and external challenges,” and that “profitability will likely be impacted as we continue to invest resolutely.”

Competitive Pressures and Market Saturation

PDD Holdings operates in a highly competitive market, both domestically and internationally. In China, PDD competes with e-commerce giants like JD.com and Alibaba, while globally, it faces challenges from established players such as Amazon. The Chinese e-commerce market is also becoming increasingly saturated, with weak consumer growth further complicating the landscape.

Analysts, including Ben Harburg, portfolio manager at CoreValues Alpha, noted that the sell-off might also be related to the broader slowdown in China’s e-commerce sector. Harburg pointed out that PDD’s competitors, JD.com and Alibaba, also reported weak second-quarter results, indicating that the challenges PDD faces are not unique.

Despite the steep decline in PDD Holdings’ stock, some analysts believe this presents a buying opportunity for investors. With the company continuing to post strong growth figures and investing in long-term strategic initiatives, the current dip may be more of a temporary setback than a sign of deeper issues.

As the e-commerce landscape evolves, PDD Holdings will need to navigate intensified competition and market saturation, but with strong underlying profitability and growth potential, the future may still hold promise for this Chinese tech giant.

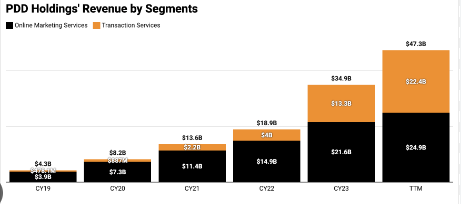

Detailed Financial Metrics:

- Year-over-Year Comparisons: Include more specific year-over-year comparisons for various financial metrics such as gross profit, operating expenses, and net income margins.

- Earnings Per Share (EPS): Provide information on the company’s earnings per share (EPS) and how it compared to analysts’ expectations.

- Market and Industry Context:

- Market Share Data: Include statistics on PDD Holdings’ market share in the Chinese e-commerce industry, comparing it with competitors like Alibaba and JD.com.

- Industry Growth Trends: Add data on the overall growth of the e-commerce market in China and globally, highlighting PDD’s position within these trends.

- Competitive Analysis

- Competitor Performance: Include recent performance data for competitors such as JD.com and Alibaba to provide context on how PDD’s results compare within the industry.

- Comparison of Key Metrics: Compare key metrics like user growth, average order value, and customer acquisition costs between PDD Holdings and its competitors.

- Geographic Expansion:

- International Growth: Provide more data on PDD Holdings’ international expansion, such as the growth rate of Temu in the U.S. market and other international markets.

- Revenue Distribution: Break down the company’s revenue by region to show how much of it comes from China versus international markets.

- Customer and User Base:

- Active Users: Include data on the number of active users on Pinduoduo and Temu, highlighting growth or decline.

- Customer Retention Rates: Provide information on customer retention rates and how they compare to industry benchmarks.

- Strategic Initiatives and Investments:

- Investment Figures: Detail the amount PDD Holdings is investing in new technologies, logistics, and international expansion.

- Partnerships: List any strategic partnerships or acquisitions that could impact future growth, such as collaborations with logistics companies or technology providers.

- Economic and Regulatory Factors:

- Impact of Economic Conditions: Discuss how current economic conditions in China, such as consumer spending trends, are impacting PDD Holdings.

- Regulatory Environment: Provide insights into any regulatory challenges PDD Holdings may be facing in China or in international markets.

- Analyst Forecasts and Market Sentiment:

- Future Earnings Projections: Include analysts’ projections for PDD Holdings’ future earnings, revenue, and growth.

- Market Sentiment: Analyze how market sentiment has shifted following the earnings report, using data from stock performance before and after the report.