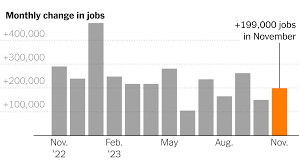

Work creation gave little indications of a let-up in November, as payrolls developed considerably quicker than anticipated and the joblessness rate fell notwithstanding indications of a debilitating economy.

Nonfarm payrolls rose by 199,000 for the month, somewhat better than the 190,000 Dow Jones gauge and in front of the October gain of 150,000, the Work Division announced Friday.

The joblessness rate declined to 3.7%, contrasted with the conjecture for 3.9%.

Normal hourly profit, a key expansion pointer, expanded by 0.4% for the month and 4% from a year prior. The month to month increment was somewhat in front of the 0.3% gauge, however the yearly rate was in line.

Markets showed blended response to the report, with securities exchange fates unobtrusively negative while Depository yields flooded.

Medical care was the greatest development industry, adding 77,000. Other huge gainers included government (49,000), producing (28,000) and relaxation and friendliness (40,000).

Heading into the Christmas season, retail lost 38,000 positions, a big part of which came from retail chains. Transportation and warehousing likewise showed a decay of 5,000.

Span of joblessness fell forcefully, dropping to a typical 19.4 weeks, the most minimal level since February.

The report comes at a crucial time for the U.S. economy.

However development overcame boundless presumption for a downturn this year, most financial specialists expect a sharp log jam in the final quarter and lukewarm increases in 2024.

Central bank authorities are watching the positions numbers intently as they keep on attempting to cut down expansion that had been running at a four-decade high yet has given indications of late of facilitating.

Prospects markets estimating firmly focuses to the Fed stopping its rate-climbing effort and starting to cut one year from now, however national bank authorities have been more vigilant about what lies ahead. Evaluating had been highlighting the principal cut occurring in Spring, however that swung following the positions report, pushing a higher likelihood for the primary anticipated that cut presently should May.

The Fed will hold its two-day strategy meeting one week from now, and financial backers will be searching for hints about how authorities view the economy.

Policymakers have been hoping to get the economy for a delicate handling that probably would highlight unassuming development, a reasonable speed of pay increments and expansion basically advancing back to the Federal Reserve’s 2% expansion target.

Purchasers hold the way in to the U.S. economy, and by most measures they’ve held up genuinely well.

Retail deals fell 0.1% in October however were still up 2.5% from the earlier year. The numbers are not adapted to expansion, so they show that shoppers essentially have almost stayed up with greater costs. A check the Fed utilizes showed expansion running at a 3.5% yearly rate in October, barring food and energy costs.

Nonetheless, there is a few concern that the Coronavirus period upgrade installments and the proceeded with tension from higher loan fees could eat into spending.

Net family abundance fell by about $1.3 trillion in the second from last quarter to about $151 trillion, owing to a great extent to decreases in the financial exchange, as per Took care of information delivered for the current week. Family obligation rose 2.5%, near the speed of the beyond a few quarters.

Taken care of authorities have been watching wage information intently. Rising costs will more often than not feed into compensation, possibly making a twisting that can be challenging to control.