Keywords: U.S. export controls, semiconductor industry, quantum computing, advanced chipmaking tools, China semiconductor advancements, global trade, tech dominance, BIS export rules, U.S.-China rivalry, ASML

The U.S. enforces stringent new export controls on critical technologies like quantum computing and advanced semiconductor tools, aiming to curb China’s rapid advancements in the global chip industry. Explore the impact on international trade and tech dominance.

In a bold move to maintain its technological supremacy, the Biden administration has unleashed a new wave of export controls targeting critical technologies, including quantum computing and advanced semiconductor equipment. As China makes significant strides in the semiconductor sector, the U.S. is intensifying its efforts to limit Beijing’s access to cutting-edge tools essential for AI and other high-stakes applications.

Unveiling the New Export Controls

The U.S. Department of Commerce has rolled out stringent restrictions that cover a broad spectrum of critical technologies. The latest rules clamp down on the export of quantum computers and their components, advanced chipmaking tools, high-bandwidth chips pivotal for artificial intelligence, and specific components related to metals and metal alloys. These measures are part of a concerted effort to stymie China’s technological progress and safeguard national security.

Alan Estevez, undersecretary of the Department of Commerce’s Bureau of Industry and Security (BIS), underscored the urgency of these actions, stating, “Today’s action ensures our national export controls keep step with rapidly evolving technologies and are more effective when we work in concert with international partners.” The BIS is also engaging in extensive discussions with global allies to align these controls, making it increasingly difficult for adversaries to exploit advanced technologies.

Global Implications and Industry Resistance

While the new export controls apply globally, the U.S. has carved out exemptions for nations that implement similar restrictions, such as Japan and the Netherlands. The BIS anticipates that other countries will follow suit, creating a united front against the proliferation of advanced technologies in potentially hostile nations.

However, the global semiconductor industry is grappling with the implications of these sweeping measures. China, the world’s largest semiconductor market, remains a vital customer for leading chipmakers across the globe, including those in the U.S. and Europe. The tightened controls could disrupt supply chains and have far-reaching effects on the bottom lines of these companies.

China’s Breakthroughs in Semiconductor Manufacturing

Despite the mounting restrictions, China is rapidly closing the gap in the semiconductor race. A recent analysis by Tokyo-based semiconductor research firm TechanaLye revealed that Chinese-made processor chips are now just three years behind those produced by Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC), the industry leader. This advancement highlights China’s relentless pursuit of self-sufficiency in semiconductor technology.

In response to U.S. sanctions, Beijing has poured billions into its domestic semiconductor industry, accelerating research, development, and production. This aggressive investment strategy is a clear signal that China is determined to reduce its dependency on foreign technology and emerge as a formidable player in the global tech arena.

Industry Pushback and Economic Consequences

As the U.S. doubles down on its export restrictions, resistance is brewing within the industry. The CEO of Dutch chip equipment giant ASML, a critical player in the semiconductor supply chain, recently expressed concerns that the U.S.-led restrictions are becoming increasingly “economically motivated.” He warned that these measures could be more about advancing U.S. economic interests at the expense of global competition, sparking fears of long-term damage to international trade.

South Korea’s Trade Minister, Cheong Inkyo, echoed these sentiments, urging the U.S. to offer more incentives if it expects countries like South Korea to adhere to stricter export controls on China. The minister’s comments highlight the growing tension between economic pragmatism and geopolitical strategy.

China’s Strategic Response and the Future of the Global Chip Industry

China has consistently denounced the U.S. and its allies’ chip restrictions as anti-competitive and detrimental to the global semiconductor supply chain. Beijing argues that these controls not only hinder technological innovation but also disrupt global markets, ultimately harming consumers.

As the U.S. continues to ramp up its efforts to curb China’s technological ascent, the global semiconductor industry faces an uncertain future. The outcome of this high-stakes battle will likely reshape the landscape of technology development and international trade for years to come.

The U.S.’s aggressive new export controls mark a critical juncture in the ongoing technological rivalry with China. As both nations vie for dominance in semiconductor technology and quantum computing, the global industry finds itself at a crossroads. The coming years will reveal whether these measures can successfully maintain U.S. technological leadership or if they will trigger unintended consequences in the ever-evolving landscape of global tech.

1. Detailed Impact on Global Semiconductor Companies:

- ASML’s Role: Dive deeper into ASML’s position in the semiconductor industry, including its market share, key technologies, and how U.S. restrictions impact its business operations.

- U.S. Semiconductor Firms: Analyze how leading U.S. companies like Intel, NVIDIA, and AMD are being affected by these export controls. Provide data on their revenue from Chinese markets before and after the restrictions.

- 2. China’s Semiconductor Advancements:

- Specific Companies: Highlight key Chinese semiconductor companies like SMIC (Semiconductor Manufacturing International Corporation) and their recent technological milestones.

- Investment Figures: Include specific figures on China’s investment in its semiconductor industry, such as government funding, private investments, and the establishment of new manufacturing plants.

-

3. Quantum Computing Developments:

- U.S. vs. China in Quantum Computing: Provide a comparative analysis of quantum computing advancements in the U.S. and China, including research, patents filed, and partnerships between companies and universities.

- Global Impact: Discuss the potential global implications of quantum computing technology, particularly in industries like cryptography, defense, and AI.

- 4. International Alliances and Policies:

- Japan and the Netherlands: Offer more details on how Japan and the Netherlands are aligning with U.S. policies, including any specific export controls they’ve implemented and the impact on their domestic industries.

- EU and South Korea’s Stance: Explore how other key players like the European Union and South Korea are navigating these export controls and their economic and diplomatic strategies.

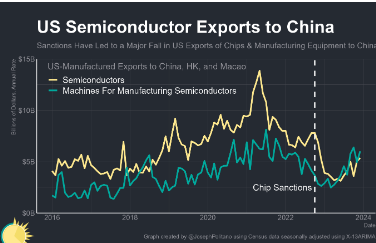

- Economic and Trade data :

- Global Semiconductor Market: Provide updated data on the global semiconductor market size, growth forecasts, and how the U.S.-China tensions are expected to influence market dynamics.

- China’s Import-Export Figures: Include data on China’s semiconductor imports and exports, particularly how these numbers have shifted in response to the U.S. sanctions.

6. Expert Opinions and Forecasts:

- Industry Analysts: Incorporate quotes and insights from leading industry analysts on the long-term impact of these export controls on the global semiconductor supply chain.

- Economic Forecasts: Present economic forecasts that predict how these controls might shape global tech markets, including potential shifts in manufacturing hubs or changes in R&D investments.

7. Historical Context:

- Previous Export Controls: Discuss previous instances of U.S. export controls on critical technologies and their outcomes, offering a historical perspective on current policies.

- Evolution of U.S.-China Tech Rivalry: Provide a timeline or summary of key events in the U.S.-China technological rivalry, including past sanctions, trade wars, and diplomatic efforts.

8. Geopolitical Implications:

- Global Tech Leadership: Analyze how these export controls might influence the broader geopolitical landscape, particularly the competition for global tech leadership between the U.S. and China.

- Bilateral Relations: Discuss the potential impact on U.S.-China relations, including trade negotiations, diplomatic tensions, and possible retaliatory measures from China.

9. Case Studies and Real-World Examples:

- Impact on Specific Products: Include case studies on specific semiconductor products or technologies that have been directly affected by the export controls, detailing the consequences for both U.S. and Chinese firms.

- Supply Chain Disruptions: Provide examples of supply chain disruptions caused by these controls, particularly in industries that rely heavily on semiconductors, such as automotive or consumer electronics.

10. Technological Alternatives and Innovations:

- China’s Alternatives: Explore how China is developing or sourcing alternative technologies to bypass U.S. restrictions, including partnerships with non-U.S. companies or the development of domestic substitutes.

- Emerging Technologies: Highlight any emerging technologies or innovations in the semiconductor field that could potentially mitigate the impact of export controls on global supply chains