UBS Global Wealth Management’s Kelvin Tay has cautioned against investing in Japanese stocks, likening it to “catching a falling knife.” Tay attributes the Japanese market’s recent gains to the weak yen, which has since reversed course, leading to a decline in stocks.

Key Points:

The Japanese market is heavily influenced by the yen’s value, with a weak yen driving gains in the past two years.

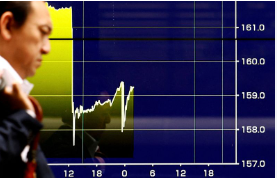

The yen’s recent strengthening has led to a decline in stocks, with the Nikkei 225 and Topix indices falling over 7%.

UBS expects the yen to continue strengthening, potentially reaching 143 against the dollar, making Japanese stocks less attractive.

The Bank of Japan’s decision to raise interest rates and trim bond purchases has contributed to the yen’s strengthening.

Tay advises against investing in Japanese stocks until the market becomes more attractive.

Export-oriented firms and trading houses are likely to be affected by the stronger yen, eroding their competitiveness.

UBS Global Wealth Management’s Kelvin Tay has cautioned against investing in Japanese stocks, likening it to “catching a falling knife.” Tay attributes the Japanese market’s recent gains to the weak yen, which has since reversed course, leading to a decline in stocks.

UBS expects the yen to continue strengthening, potentially reaching 143 against the dollar, making Japanese stocks less attractive.

The Bank of Japan’s decision to raise interest rates and trim bond purchases has contributed to the yen’s strengthening.

Tay advises against investing in Japanese stocks until the market becomes more attractive.

Market Impact:

The Nikkei 225 and Topix indices have extended their declines, falling over 7% and approaching bear market territory.

The yen has strengthened to its lowest level against the dollar since January, pressuring Japanese stocks.

Export-oriented firms and trading houses are likely to be affected by the stronger yen, eroding their competitiveness.

Optimistic Outlook: UBS maintains an optimistic outlook on Japanese stocks, predicting further upside despite the Bank of Japan’s recent interest rate hike

Nikkei 225 Forecast: UBS analysts expect the Nikkei 225 to hit new record highs, potentially reaching 45,000 .

Value Stock Growth: UBS forecasts growth for Japanese value stocks in 2024, building on the robust rally seen this year .

Equities Rise: Japanese equities have risen past their 1989 peak, indicating a positive trend .

Asian Market Drivers: UBS analysts identified six key factors driving Asian markets in the second half of 2024, including the Japanese stock market .

Key Factors Influencing Japanese Stocks

Yen Strengthening: The strengthening of the yen may impact Japanese stocks, but UBS expects the impact to be manageable ¹.

Inflation Dynamics: Japan’s inflation dynamics and corporate reform progress are expected to drive investor confidence and broaden the equity rally .

Earnings Growth: Solid corporate earnings growth is expected, with valuations remaining fair compared to global markets ¹.- Optimistic Outlook: UBS maintains an optimistic outlook on Japanese stocks, predicting further upside despite the Bank of Japan’s recent interest rate hike

Nikkei 225 Forecast: UBS analysts expect the Nikkei 225 to hit new record highs, potentially reaching 45,000 ².

Value Stock Growth: UBS forecasts growth for Japanese value stocks in 2024, building on the robust rally seen this year ³.

Equities Rise: Japanese equities have risen past their 1989 peak, indicating a positive trend ⁴.

Asian Market Drivers: UBS analysts identified six key factors driving Asian markets in the second half of 2024, including the Japanese stock market .