URL: walmart-q2-earnings-report-2024-analyst-expectations-economic-outlook

Descripition

Walmart’s Q2 earnings report could offer crucial insights into consumer behavior and the broader economic outlook. Learn what analysts expect and what it means for the economy.

Walmart is set to release its highly anticipated Q2 earnings report before the market opens on Thursday, August 15, 2024. As the largest retailer in the United States, Walmart’s performance is a critical indicator of consumer health and the overall economic outlook, making this report a must-watch for investors and economists alike.

Key Analyst Expectations for Walmart’s Q2 Earnings:

Earnings per Share (EPS): Analysts predict Walmart will report earnings of 65 cents per share.

Revenue: Consensus estimates suggest $168.53 billion in revenue.

Walmart’s reputation as a value-oriented retailer has drawn in a diverse customer base, including a significant influx of higher-income shoppers seeking relief from inflation. Although inflation has moderated, prices remain stubbornly high compared to pre-pandemic levels, straining household budgets and prompting shifts in consumer behavior.

Why Walmart’s Earnings Matter:

Walmart’s quarterly earnings reports are more than just a reflection of the company’s financial health—they serve as a barometer for the retail industry and the broader economy. The company’s ability to maintain or exceed expectations could suggest that consumers are still managing despite economic headwinds. However, any signs of weakness in Walmart’s performance could signal deeper economic challenges, particularly as other major retailers like Home Depot have already issued cautious outlooks.

Growth Beyond Traditional Retail:

Walmart has been proactively expanding beyond its traditional retail operations. Key initiatives include bolstering its third-party marketplace, increasing advertising revenues, and driving membership growth for its Walmart+ subscription service. The retailer has also launched a new grocery brand, Bettergoods, offering affordable meal solutions that cater to budget-conscious consumers.

Stock Performance:

Walmart’s stock has been a standout performer in 2024, closing at $68.66 on Wednesday, representing a 31% increase year-to-date. This performance has significantly outpaced the S&P 500, which has gained approximately 14% during the same period.

What to Watch For:

Investors and analysts will be closely monitoring Walmart’s earnings report for any shifts in consumer behavior and economic outlook. A strong report could reinforce confidence in the consumer economy, while any disappointment might raise alarms about broader economic challenges.

- Previous Earnings Comparison: A comparison with Walmart’s earnings from the same quarter last year (Q2 2023) and the previous quarter (Q1 2024) to show trends in revenue and earnings per share (EPS).

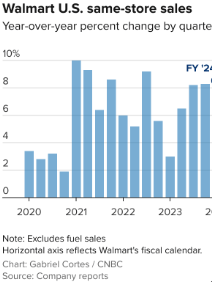

- Year-over-Year Growth: Data on Walmart’s year-over-year revenue growth, highlighting how the company’s performance has evolved in response to economic challenges such as inflation.

- Demographic Shifts: Information on how different income groups are shopping at Walmart, including any noticeable increase in higher-income shoppers due to inflationary pressures.

- Product Categories Performance: Breakdown of which product categories are performing well (e.g., groceries, electronics, apparel) and which ones are lagging, giving a clearer picture of consumer priorities.

- Impact of Inflation on Shopping Habits: Specific examples or data points illustrating how inflation has changed consumer shopping habits, such as a shift from premium brands to Walmart’s private label brands.

- Walmart+ Membership Growth: Updated figures on the number of Walmart+ subscribers, as well as any new features or benefits added to the program.

- Advertising Revenue: Growth figures for Walmart’s advertising business, including key partnerships or new advertising formats that have been introduced.

- Expansion of Third-Party Marketplace: Details on the expansion of Walmart’s third-party marketplace, including the number of new sellers added, categories expanded, and any international sellers joining the platform.

- Inflation Trends: More detailed analysis of how inflation has trended over the past year and its impact on consumer spending, with specific reference to sectors most affected.

- Comparison with Other Retailers: How Walmart’s performance compares to other major retailers like Amazon, Target, and Home Depot, particularly in response to similar economic challenges.

- International Performance: Data on Walmart’s international operations, including revenue from key markets like Mexico, Canada, and India, and how these regions are contributing to the overall financial performance.

- Currency Impact: How fluctuations in currency exchange rates have impacted Walmart’s international sales and profit margins.

- Analyst Ratings: A summary of recent analyst ratings for Walmart’s stock, including price targets and the rationale behind those ratings.

- Stock Performance Comparison: Comparison of Walmart’s stock performance with that of its competitors and the broader market, including a discussion on investor sentiment heading into the earnings report.

- E-commerce Growth: Data on the growth of Walmart’s e-commerce sales, particularly during key shopping periods such as back-to-school and holiday seasons.

- Innovations in Supply Chain: Information on any technological innovations Walmart has implemented to improve its supply chain efficiency, particularly in response to the challenges posed by the pandemic and ongoing global supply chain disruptions.

Guidance for the Rest of 2024: What analysts and Walmart itself are projecting for the remainder of 2024, including any revisions to full-year guidance or potential risks and opportunities

- Macroeconomic Factors: How broader economic factors, such as interest rates, consumer confidence, and geopolitical events, could impact Walmart’s performance in the coming quarters.

Charts and Graphs: Include visual representations such as charts showing Walmart’s revenue and EPS trends, consumer spending shifts, and stock performance comparisons.

- Infographics: Infographics summarizing key data points like inflation’s impact on spending or Walmart’s market share in various product categories.