KEYWORDS

Japanese Yen, U.S. Inflation Data, Federal Reserve Rate Cuts, Currency Markets, Yen Carry Trade, Forex News, Economic Data, Global Markets, Federal Reserve, USD/JPY

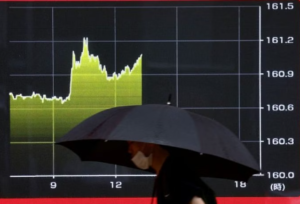

SINGAPORE, August 12, 2024 – The Japanese yen continued its gradual decline against the U.S. dollar on Monday amid thin trading volumes due to a Japanese holiday. Market participants are closely monitoring U.S. inflation data, which is expected to significantly influence Federal Reserve rate decisions and further affect global currency and stock markets.

Yen Decline Amid Market Uncertainty

The yen fell to 147.15 per dollar, marking a 0.4% decrease. This decline follows a tumultuous week characterized by a massive selloff in global currencies and stock markets. The selloff was driven by concerns over the U.S. economy and the Bank of Japan’s hawkish stance on interest rates. However, the end of the week saw some stabilization due to stronger-than-expected U.S. jobs data, which led markets to scale back their expectations for aggressive Federal Reserve rate cuts in 2024.

Despite this stabilization, market sentiment remains cautious. Investors are currently pricing in 100 basis points of rate easing by the end of the year, a scenario typically associated with an impending recession. This ongoing uncertainty makes markets highly sensitive to upcoming economic data and events.

Key Upcoming Events

- U.S. Producer and Consumer Price Index (CPI) Reports: Scheduled for release on Tuesday and Wednesday, respectively, these reports will provide insight into inflationary pressures and could influence Federal Reserve policy decisions.

- Global Central Bankers’ Meeting: The annual Jackson Hole meeting next week will feature discussions on global economic conditions and central bank policies, which may impact market expectations.

- Nvidia Earnings Report: Later this month, earnings from Nvidia, a leading tech company, will be scrutinized for insights into the tech sector’s health and its broader market implications.

Expert Insights

Christopher Wong, a currency strategist at OCBC Bank in Singapore, observed, “The current market movements are largely driven by investors positioning themselves ahead of the U.S. inflation data.” Analysts at Mizuho echoed this sentiment, noting that upcoming jobs and inflation data releases will play a crucial role in shaping market expectations. They described the current market situation as “finely balanced” with a “coin toss probability,” reflecting the uncertainty surrounding future Federal Reserve actions.

Currency Performance

- Euro: Stable at $1.0920, with recent highs reaching $1.1009, the strongest level since January 2.

- Australian Dollar: Slightly up at $0.6584.

- New Zealand Dollar: Trading at $0.6015, below last week’s three-week high of $0.6035.

Central Bank Policies

- Reserve Bank of New Zealand: Expected to maintain its key cash rate at 5.50% during its policy review on Wednesday.

Impact of Yen Carry Trade Unwinding

The recent market turmoil was significantly influenced by the unwinding of the yen carry trade. This trading strategy involves borrowing yen at low interest rates to invest in higher-yielding assets. The violent selloff in the dollar-yen pair between July 3 and August 5, driven by Japan’s intervention and adjustments in yen-funded carry trades, caused the pair to drop by 20 yen.

Data from the U.S. Commodity Futures Trading Commission and LSEG revealed that leveraged funds’ net short positions on the yen have decreased to their smallest level since February 2023. The yen hit a peak of 141.675 per dollar last Monday but remains down 4% against the dollar year-to-date.

Volatility Trends

Implied volatility on the yen, as measured by yen options, has decreased significantly. After peaking at 31% on August 6, volatility has now subsided to around 5%, indicating reduced market uncertainty regarding future yen movements.

As markets await crucial U.S. inflation data and other significant events, the yen’s continued decline underscores the ongoing uncertainties in global financial markets. Investors will closely monitor economic indicators and central bank actions to gauge future currency and market trends.

Meta Description: The Japanese yen continues to slide against the U.S. dollar amid market uncertainty. Key upcoming U.S. inflation data, central bank meetings, and tech earnings are expected to impact global currency and stock markets.