Key Tags: European markets, FTSE 100, DAX, CAC 40, Chinese stimulus, global economy, stock market, Asia-Pacific markets, Wall Street, Federal Reserve, investor sentiment

London — European markets opened in the red on Wednesday, reversing the previous session’s gains driven by China’s recent economic stimulus measures. Investor sentiment is cooling after the initial boost provided by the policy changes from Beijing, which aimed to jumpstart China’s slowing economy.

Key Market Declines Across Europe:

- FTSE 100 (UK): Set to fall 46 points to 8,237

- DAX (Germany): Expected to drop 49 points to 18,924

- CAC 40 (France): Forecasted to dip 27 points to 7,568

- FTSE MIB (Italy): Predicted to slump 181 points to 33,686

On Tuesday, European stocks surged, with the mining, technology, and consumer goods sectors leading the charge. This positive momentum came in response to China’s central bank’s stimulus—a suite of policy easing measures designed to ignite growth in the world’s second-largest economy.

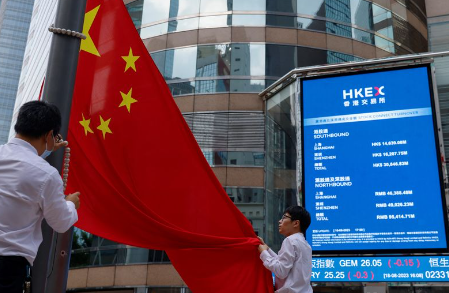

Asia-Pacific Rally Driven by China’s Policy Easing

China’s announcement also sent Asia-Pacific markets soaring on Tuesday, with Hong Kong’s Hang Seng Index climbing an impressive 2.2%. Meanwhile, mainland China’s CSI 300 recorded its biggest single-day gain in over four years, reflecting strong confidence in the economic boost from Beijing’s actions.

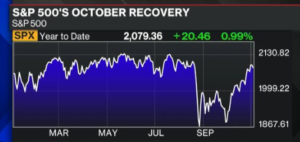

U.S. Markets Hold Steady Amid Economic Concerns

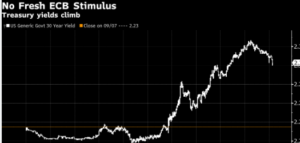

Across the Atlantic, U.S. stock futures remained stable Tuesday evening, as Wall Street eyes a positive end to September despite economic slowdown concerns following last week’s Federal Reserve interest rate cut. Although major U.S. indexes remain on track for gains this month, traders are wary of potential headwinds in the final quarter of 2024.

No Major Earnings or Data on Tap for Europe

With no significant earnings reports or economic data releases scheduled in Europe on Wednesday, markets are expected to remain volatile as investors digest the longer-term implications of China’s stimulus.

As the global economic landscape continues to evolve, market participants will keep a close eye on further developments out of China and their potential ripple effects on European and U.S. markets. Europe’s volatile trading reflects both cautious optimism and the underlying uncertainty surrounding global growth prospects. European markets are experiencing a slight downturn after receiving a temporary boost from China’s aggressive stimulus measures aimed at reviving its slowing economy. Following the People’s Bank of China’s intervention, sectors like mining, technology, and household goods rallied, with companies such as Glencore and Rio Tinto benefiting from heightened resource demand. However, this initial enthusiasm is fading as investors weigh the longer-term effects of China’s policy actions.

China’s stimulus measures had initially spurred optimism across global markets, with the Hang Seng Index in Hong Kong seeing significant gains. Nonetheless, the sustainability of this boost is being questioned, especially as analysts anticipate more challenges ahead for the Chinese economy, particularly in sectors like real estate.

In Europe, key indices such as the UK’s FTSE 100, Germany’s DAX, and France’s CAC 40 opened lower today. This comes amidst ongoing caution surrounding global economic conditions, including the Federal Reserve’s monetary policy in the U.S. and concerns over inflation driven by rising energy prices. Commodity markets, particularly crude oil, remain volatile, further impacting market sentiment.

While the immediate impact of China’s policy has faded, many analysts are keeping a close eye on potential long-term effects, particularly in sectors heavily exposed to Chinese demand, such as automotive, energy, and luxury goods.

The recent pullback in European markets comes after an initial surge driven by China’s economic stimulus aimed at stabilizing its economy, particularly focusing on sectors like real estate and consumer demand. China’s policies, such as easing credit conditions and supporting infrastructure projects, initially boosted global investor sentiment, particularly in Europe and Asia. The Hang Seng Index saw a strong rally, while mainland China’s CSI 300 had its best day in years. However, the boost from China’s intervention is now seen as short-lived, with European markets opening lower on concerns that these measures may not sustain long-term growth, especially given ongoing global economic challenges. Key European indices, including the FTSE 100, DAX, and CAC 40, all saw declines as the excitement from the stimulus faded. Mining stocks like Glencore and Rio Tinto, which had benefited from heightened demand for raw materials in the wake of China’s moves, also experienced a slight dip as caution returned to the market. Additionally, while China’s real estate sector showed some improvement, analysts warn that the full impact of the stimulus remains to be seen, especially with U.S. markets stabilizing and concerns about inflation and energy prices persisting in Europe. Crude oil prices, which have been hovering near yearly highs, further complicate the outlook as continued production cuts and potential demand increases from China could fuel inflation(Overall, while China’s policies initially boosted global markets, the rally has been tempered by broader economic concerns and uncertainty about the long-term effectiveness of the stimulus.